If you’re both a cruiser and a Carnival shareholder, this time of year always brings a little suspense. We all wait for that official word: “Will Carnival Corporation extend the Carnival Shareholder Benefit?” In true Carnival fashion, the announcement comes late, but there’s good news! We’ve got the full 2026 Carnival Shareholder Benefit update right here, along with everything you need to know about claiming your 2026 Carnival Shareholder Benefit (through December 2026).

2026 Carnival Shareholder Benefit Update

Carnival Corporation has officially extended the Carnival Shareholder Benefit for 2026. That means eligible shareholders will continue receiving up to $250 in onboard credit every time they sail on participating Carnival Corporation brands. The 2026 Carnival Shareholder Benefit applies to sailings through December 31, 2026.

The 2026 benefit structure remains the same for North America brands:

| Length of Sailing | Onboard Credit (OBC) |

| 14 days or longer | $250 |

| Sailings 7-13 days | $100 |

| Sailings 6 days or less | $50 |

The current 2025 Shareholder Benefit is still in place through December 31, 2025. That’s when the new program takes over and extends the shareholder credit by one year.

2026 Carnival Shareholder Benefit Requirements

To qualify for the 2026 Shareholder Benefit, you must own at least 100 shares of Carnival Corporation (CCL) stock. Had you purchased these shares at their low this year, you would have invested $1,507. Fast forward to the time of this writing, and the cruise operator’s stock is trading at $25.98. That means, you’d now need to invest $2,598 for those same 100 shares.

Is the Carnival Shareholder Benefit Worth It?

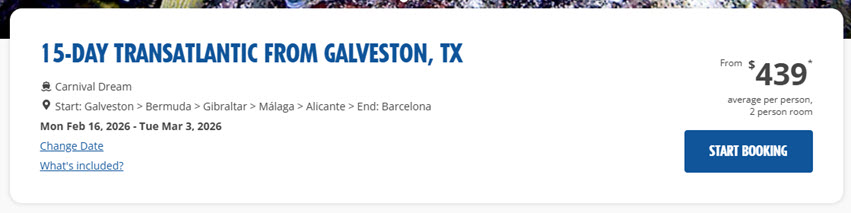

For those wondering, “Is buying 100 shares of Carnival stock worth it?”, here’s an example. Let’s say you’ve been thinking about that fantastic deal on the 15-day transatlantic on Carnival Dream… That one sailing would earn you $250 OBC in benefit alone. At today’s stock price, that’s nearly a 10% return on your investment in just a single cruise!

And those other six cruises you’ve already got on the books over the next 12 months? That’s another $600 in OBC on 7-day sailings – close to 25% return! With over 60 Carnival cruises under our belts, the onboard credit has paid us back multiple times over the years.

As always, please remember, we are not financial advisors and are not providing financial advice.

Participating Carnival Corporation Brands

One of the best parts of this program is that ALL Carnival Corporation brands participate, not just Carnival Cruise Line. For example, Rocky recently earned shareholder OBC while sailing Holland America, and we’ll be doing the same on Princess in 2026.

Participating brands include:

- AIDA Cruises

- Carnival Cruise Line

- Costa Cruises

- Cunard

- Holland America Line (HAL)

- P&O Cruises

- Princess Cruises

- Seabourn

If it’s under the Carnival Corporation umbrella, the shareholder benefit applies!

Requesting the 2026 Carnival Shareholder Benefit

For the second year in a row, Carnival requires passengers to use the StockPerks App to submit shareholder verification. While cruisers continue to share negative feedback about this process, the requirement remains firmly in place for 2026.

How to request 2026 Carnival Shareholder Benefit

You must download the StockPerks App on iOS or Android, create an account, and upload proof of your share ownership. The process can feel a bit cumbersome the first time, but once verified, future requests go more smoothly.

We’ve created a full step-by-step StockPerks one-pager to guide cruisers through the StockPerks submission process, including helpful tips for those concerned about data privacy.

Important: According to Carnival, requests must be submitted at least 3 weeks prior to sailing, so don’t wait!

Fine Print and Disclaimers

Like prior years, Carnival outlines a bunch of fine print for the 2026 Shareholder Benefit:

- 2026 Carnival Shareholder Benefit is available to shareholders that own a minimum of 100 shares of Carnival Corporation stock in a single investment account

- The 2026 Carnival Shareholder Benefit applies to sailings through December 31, 2026

- You must request your 2026 Carnival Shareholder Benefit via StockPerks at least 3 weeks prior to departure; onboard credits cannot be processed onboard during your cruise

- Only one 2026 Carnival Shareholder Benefit credit is permitted per stateroom (even if you and your roommate both hold 100 shares of Carnival Corporation stock, only one Shareholder Benefit credit will be applied)

- Shareholder must sail on the cruise; the 2026 Carnival Shareholder Benefit is non-transferable

- The 2026 Carnival Shareholder Benefit cannot be redeemed for cash or used for casino charges

- Carnival states that the 2026 Carnival Shareholder Benefit cannot be used to pay gratuities, however, we’ve not seen this enforced and many fellow cruisers have confirmed this

- Reduced-rate (casino players, this includes you!), travel-agent, interline, or complimentary fares are not eligible for the 2026 Carnival Shareholder Benefit

- Carnival reserves the right to modify or end the benefit at any time

As a reminder: with any investment, there is risk, and tax implications may apply. None of this article constitutes financial advice.

Carnival Shareholder Benefit Changes with Carnival Rewards

One of the things we’ll be watching closely is how the Carnival Shareholder Benefit evolves with the launch of Carnival Rewards. As Carnival Cruise Line retires their popular VIFP Loyalty Program and rolls out the new program, will Carnival tweak the Carnival Shareholder Benefit? Sign up for our newsletter to get cruise news and updates delivered to your inbox.

Here’s to another year of smooth sailing, and a little extra spending money onboard!